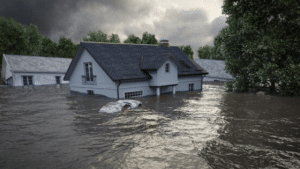

Flood Claims and Insurance Policy Statistics

After September 2020, approximately 60 insurance companies took part in the undertaking “Write Your Own Program”.

Also known as the WYO program, this program began in 1983. It is one of the popular flood insurance trends. It started as a cooperative undertaking between FEMA and the private insurance industry. Under this program, the participating insurance companies write and service the SFIP with their company names.

Thus, for the claims processed and policies written, these insurance companies receive an expense allowance while the federal government retains responsibility for underwriting losses. The WYO program goals include increasing NFIP (National Flood Insurance Program) policy and geographic distribution.

Source: iii.org

Nearly 88% of the National Flood Insurance Program (NFIP) policies were held under the WYO Program.

The National Flood Insurance Program is self-supporting for the average historical loss year unless there is a significant disaster. It provides federally supported flood insurance to communities that integrate floodplain management ordinances.

The National Flood Insurance Program aims to provide primary flood insurance to properties with a high risk of flood damage and simultaneously help lower the risk by adopting floodplain management standards.

Source: iii.org

About 69% of the National Flood Insurance Program policies covered single-family homes as of the month of July 2020.

According to iii.org flood statistics, other property owners that benefited from the NFIP policies were condos and 2-4 family units. Statistics show that 21% of the NFIP policies covered condominiums, while 4% of the policies covered 2 to 4 family units.

Source: iii.org

The National Flood Insurance Program arranged approximately 1.15 billion US dollars for 2021.

These funds have been arranged from 32 private reinsurers. This figure is 5 more private reinsurers. Last year, funds were arranged by 27 private reinsurers. Furthermore, another significant change is in the reinsurance coverage cost. For 2021, the reinsurance coverage cost was $195.8 million. The figure is lower than the cost of reinsurance coverage for 2020, which was approximately $205 million.

Source: iii.org

The Federal Emergency Management Agency sought the support of $300 million Floodsmart RE Ltd for a second flood catastrophe bond.

Flood insurance claims data depicts that FEMA returned to the capital markets for the second flood catastrophe bond in March 2019 to transfer risk from the National Flood Insurance Program. This new second flood catastrophe bond provided coverage for three years. The terms, however, were similar to the first catastrophe bond issued in August 2018.

Source: Artemis

The NFIP has seen over 2.4 million flood damage claims since 1970

The Federal Emergency Management Agency or FEMA has seen its fair share of flood damage claims over the years. FEMA says that there have been over 2.4 million damage claims in the past 50 years, which represents over $70 billion in payments. In addition, the flood insurance claim history dates back to the 1970s and includes data from over 50 million policy transactions.

Source: NRDC

Flood insurance claims are increasing across the country

The number of claims is on the rise even in areas nowhere near the shore. Major flood disasters that occurred in 2008, 2012, and 2017 have seen flood insurance claims soar sky-high — hence why experts are adamant that the numbers will continue to climb.

When it comes to the National Flood Insurance Program, damage claims parallel the increasing frequency of extreme rainfall occurring in the US.

Source: Climate Signals

NFIP flood insurance claims are paid out even when a disaster is not declared by the President

FEMA’s disaster assistance is only activated after a flood has occurred. On the other hand, buying a flood insurance policy means that you’ll get paid for the damage sustained even without a Presidential disaster declaration.

This ensures that you’ll be reimbursed for the damage sustained in your home after a flood that the NFIP policy covers.

Source: FEMA

Private insurer claims on the rise as well

Private flood insurance statistics show an expansion of claims as well. Although private insurers couldn’t compete with subsidized rates in the past, competitive pricing and packages have made private companies a great alternative to the NFIP.

Source: Public Policy